Shares of our local banks are not the only ones tumbling with the COVID-19 outbreak. UOB, OCBC and DBS had over the past day announced a range of cost cutting measures such as branch closure as well as savings interest rate revision to their popular high-yield interest savings (largely dubbed as the COVID-19 savings interest rate cut). This includes UOB One Account for UOB, OCBC 360 and DBS Multiplier which I touched on a couple of years back. Let’s take a look at how drastic the cuts are and which is the best to go for now.

Why the reduction?

So why are our banks making this revision to cut interests when people needs it most? Well, the slowing global growth and COVID-19 outbreak prompted central banks across the world, including Asia, to cut their benchmark rates. This is also given the impact alongside the US Federal Reserve easing its monetary policy from July 2019.

Moreover, since June last year, Singapore inter-bank rates have also been falling. The rates are expected to stay low for an extended time, well even past when COVID-19 blows over. Henceforth, it is predictable with this reduction in line with the market trend that our 3 major banks are revising the interest rates.

UOB One is less attractive now

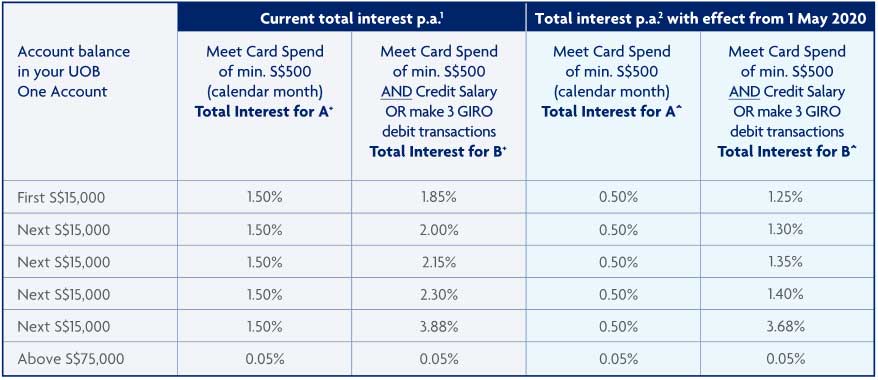

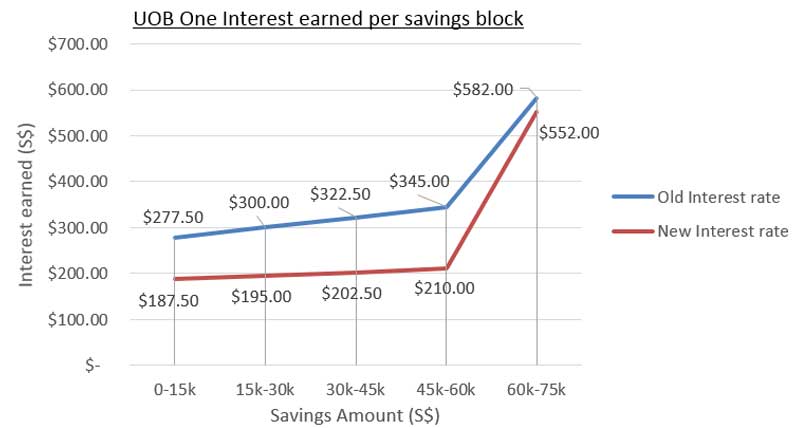

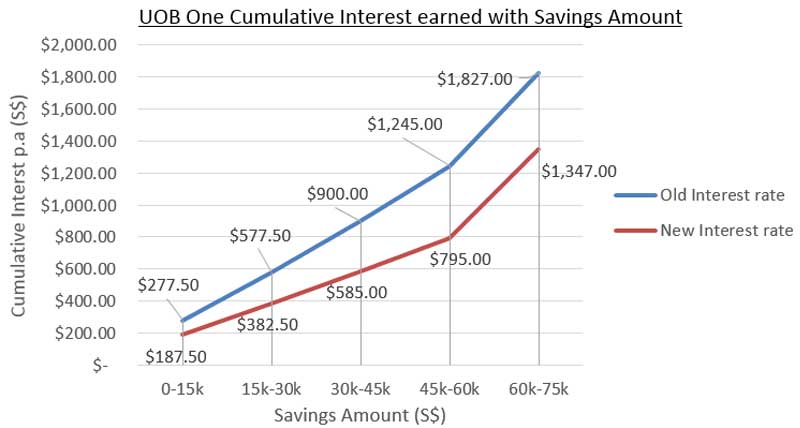

From May 1st, UOB is cutting savings interest rates across all their staggered savings tiers. The tiered calculation of interests does make it more difficult to calculate your actual interest. Also, do note that UOB claimed savings interest rate of 3.68% p.a. does not start from your first dollar, but rather applies from uses a staggered interest tier. Let’s take a closer look at the reduction across saving amounts by UOB.

From $0 to $45k savings balance (three $15k interest blocks), we see a vertical drop in potential savings interest rate across the board. Moreover, the gains in interest for every $15k block is largely linear, as opposed to escalating interest on the old rates. We see a huge jump in savings interest from $60k onwards up to the $75k cap. Also, this gives a disincentive to put cash if you have savings below $60k.

Thankfully, the two UOB criteria of card spend and salary credit/3 GIRO payments remains unchanged. So there is no need to rush to optimise or change your bank crediting details with your company HR.

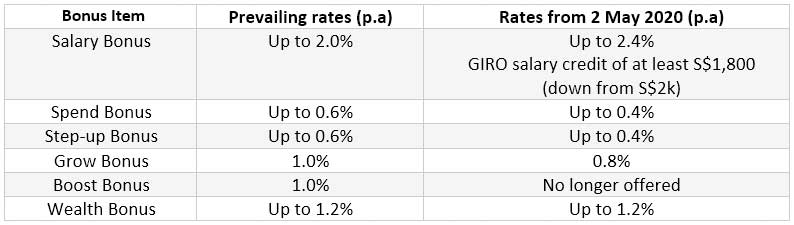

OCBC 360- least changes

OCBC interest categories see the retention of the Salary, Spend, Step-up, Grow and Wealth Bonus savings interest rate. The Boost Bonus at 1.0% is no longer offered. However, realistically, most people using the OCBC 360 will able to utilise mainly 3 areas- Salary, Spend and Step up bonus (if you are a saver with $500 nett contribution each month). Especially if you do not want to invent in any of OCBC wealth products.

Additionally, to cushion to blow of the reduction of Spend and Step-up bonus, the blow is cushioned by an increase in Salary interest from 2.0% to 2.4% p.a. Base savings interest rate remains unchanged at 0.05%, while frank account balances above $50,000 is slashed from 0.3% to 0.05%.

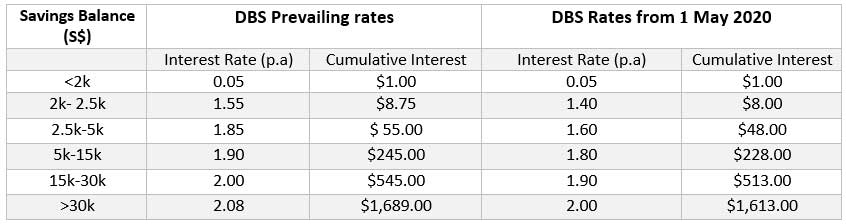

DBS Multiplier, still attractive

Additionally, from 1st May 2020. DBS Multiplier sees a peak reduction of $76 in p.a savings interest for a $70k balance ($1,613 down from $1,689). It corresponds to about a 5% decrease in saving interest. I can guess the bank is confident of being able to weather and recover from the pandemic.

However, the conditions of the multiplier account hold where you need to add up to S$2,000 every month. If you do not have that much to stash into your DBS account monthly, I would recommend the OCBC option.

Assumptions

I will be calculating your maximum achievable interest at the bank’s cap ($70k-$75k) as well as a mid-range $30k-$35k. For OCBC I am omitting the GROW bonus which grants you 0.8% interest on savings amounts on the S$70,000 if you have over S$200,000 in your account. Also, I am giving more scrutiny on UOB one account as they were the bank to offer the best high-yield saving rates for the past year.

Cutting across the board at $70-$75k savings

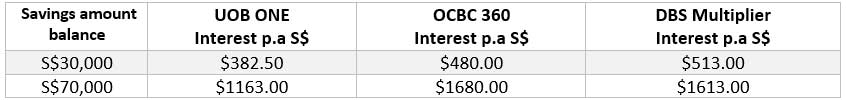

Taking a further look into the interest reduction across for UOB. While previously a savings of $75k in UOB One can get you an interest of $1.827 p.a now, you get $1,347 p.a which is $480 lower p.a. Hence, at a maxed out $75k balance, UOB interest amendments resulted in a staggering 26.3% reduction in potential savings interest per annum. In comparison, the maximum achievable savings interest earned on OCBC 360 with Salary, Send and Step-up totals to $1,680 per annum on a $70k balance.

When maxed out at $70k savings for the OCBC, the OCBC accounts, despite of a 2 tier interest rate earns you a total interest from a $70k balance of $1,680 p.a. This is a staggering 20% difference in savings interests between UOB and OCBC. At these times, you need to make your money work harder for you.

DBS and OCBC- Very close call

Bringing DBS into the picture makes things more competitive. At the $70k mark, DBS multiplier will give you $1613 of interest p.a, down from $1,689 before the interest cut. However, it is a very close call between OCBC and DBS. Also, if DBS multiplier is currently your main account, there is little incentive to shift over to OCBC as DBS offerings are still rather attractive in the market.

When maxed out at $75k for the UOB one and $70k savings for the OCBC, the OCBC accounts, despite of a 2 tier interest rate earns you a total interest from a 70k balance of $1,680 p.a.

UOB has been dethroned as the best savings account. It is a close call between DBS and OCBC, I would recommend putting your money with OCBC now. Especially for balances up to $70k. DBS is the next best, but the need to inject $2000 positive balance in this hard times makes it less realistic an attractive. OCBC gets my vote for this time period.

Which is best for $30k-35k savings?

Go for DBS Multiplier if you wish to earn the most for your money. But OCBC is not too far off as a good alternative. Moreover, at $30k savings, OCBC gives you $513 of interest p.a while UOB now gives you only $382.50 p.a, a 25% difference. It’s a no-brainer on who to go for here.

Also, in comparison, OCBC reduction of Spend and Step-up Bonus interest was made up of a surprising 0.4% increase in the Salary Bonus interest. It is the only bank which increased interest dates this month. I can guess presumably a move by the bank to look to inject more liquid funds into the bank.

Furthermore, it is worth noting that OCBC offer is still rather attractive despite removing the 1.0% interest offered by their boost bonus. It rewards you when you increase your average daily balance from the previous month’s balance. If you are a big saver who brings a nett positive to your bank account monthly, you are quite out of a luck now.

All in all, given the COVID-19 savings interest rate revisions given the outbreak, the reduction in rates saw OCBC being the new forerunner with the most attractive rates from 1st May. I can see many UOB customers potentially shifting all their cash between banks come end April. It is a very close call between OCBC and DBS, with OCBC being the more realistic option even without utilising their Wealth bonus.

Let me know what you think and if there are an questions to my comparison methods, I’d be glad to hear from you.